S.M.S.I. is an intelligent computerised “navigator” which its only limit is how far the imagination of the investor can go. Investor can rely on S.M.S.I. analysis instead of Stock Market’s emotional mood swings. There is no ideal strategy on the

right time to buy or sell, but the key is having a disciplined policy on when you should sell.

If you can be disciplined over the long term then you can have a better chance of creating more wealth.

right time to buy or sell, but the key is having a disciplined policy on when you should sell.

If you can be disciplined over the long term then you can have a better chance of creating more wealth.

ABOUT US

SMSI helps investor to identify, evaluate, implement projects that meet or even exceed investor expectations. The mission of SMSI is to help investor to maximize his/her portfolio return over time. SMSI has all the necessary tools for the investor in order to build his/her strategic plan since profit is impossible unless the investor has a well-articulated plan.

An accurate long term strategic plan is the critical key for future success. SMSI hides the financial complexity & provides only the essentials figures that are crucial for the investor's plan. Good financial decisions require an understanding of the current status of the stock market but figuring out what' s likely to happen is not an easy task but at this point SMSI comes to help you.

SERVICES

SMSI Scope – Guidance & Plan Creation

The mission of S.M.S.I. is to help investor to maximise his/her portfolio return over time. S.M.S.I. has all the necessary tools for the investor in order to build his/her strategic plan since profit is impossible unless the investor has a well-articulated plan. An accurate long term strategic plan is the critical key for future success. S.M.S.I. hides the financial complexity & provides only the essentials figures that are crucial for the investor’s plan. Good financial decisions require an understanding of the current status of the stock market but figuring out what’ s likely to happen is not an easy task but at this point S.M.S.I. comes to help you.

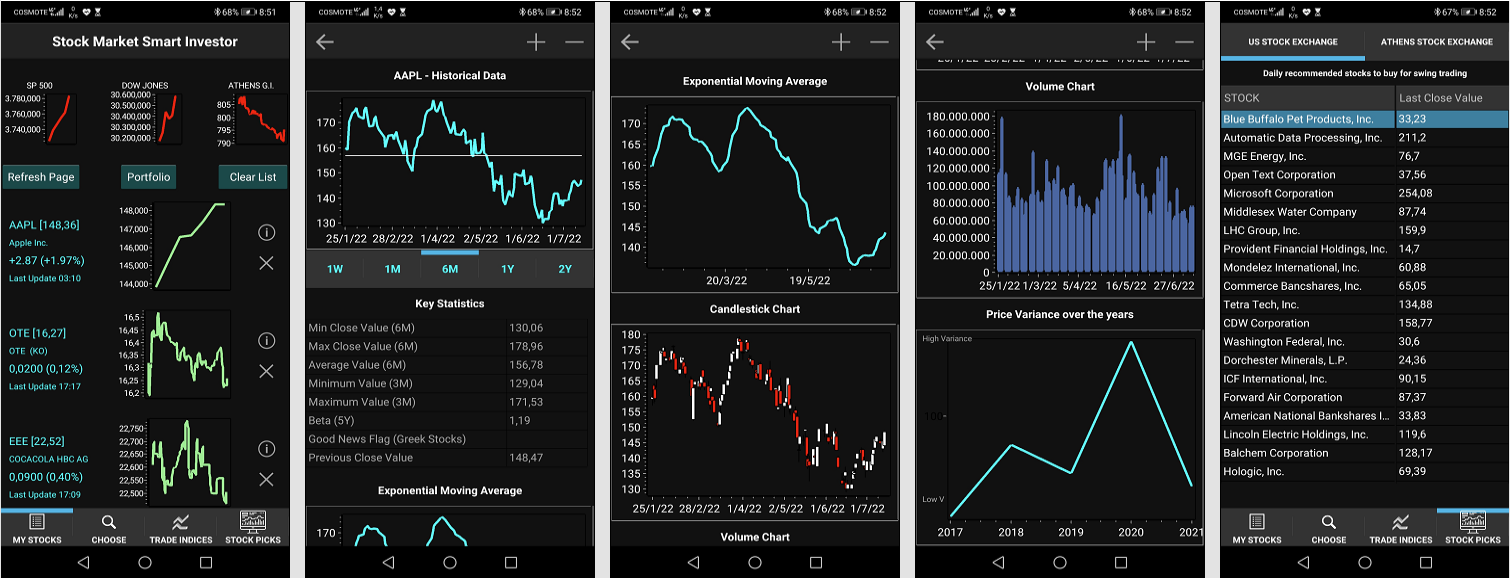

Successful Investing – Android Application

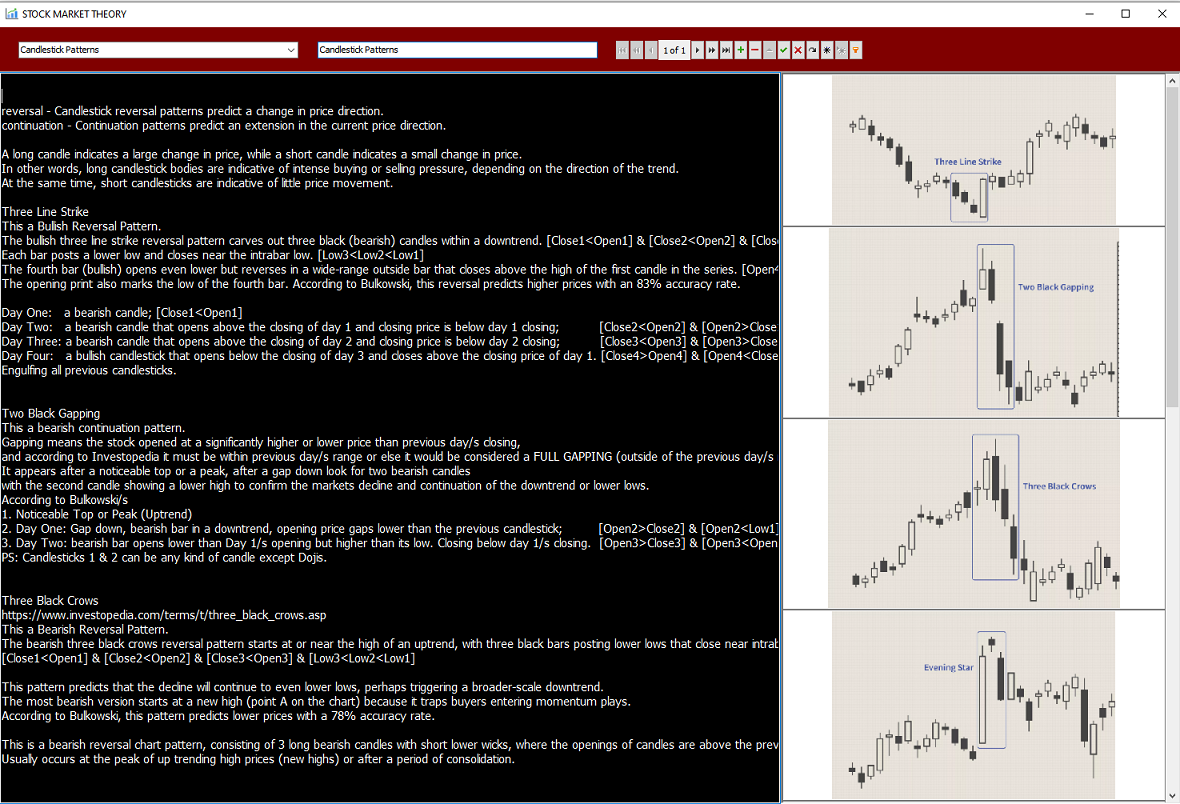

Every day after the close of stock exchange, S.M.S.I. generates an automated report suggesting a bevy of stock picks in order to make investor’s decision making process easier, faster more effective. S.M.S.I. uses an automated technique based on technical analysis & multi-day chart patterns to look for trading opportunities.S.M.S.I. uses price patterns to examine current movements and forecast future market movements. Hence, S.M.S.I. by analysing the chart of an asset determines when the investor should enter and when the investor should get out with a profit. For example, S.M.S.I. looks for Bullish and Bearish engulfing patterns since they are some of the most popular candlestick patterns. At this point, we should mark that the algorithms that create the list of suggested stocks for purchase, are based exclusively on mathematical – statistical equations of historical data.In any case, the algorithm does not guarantee that this list of stocks will surely bring profit. After all, we should not forget that stockbroking is a form of gambling.

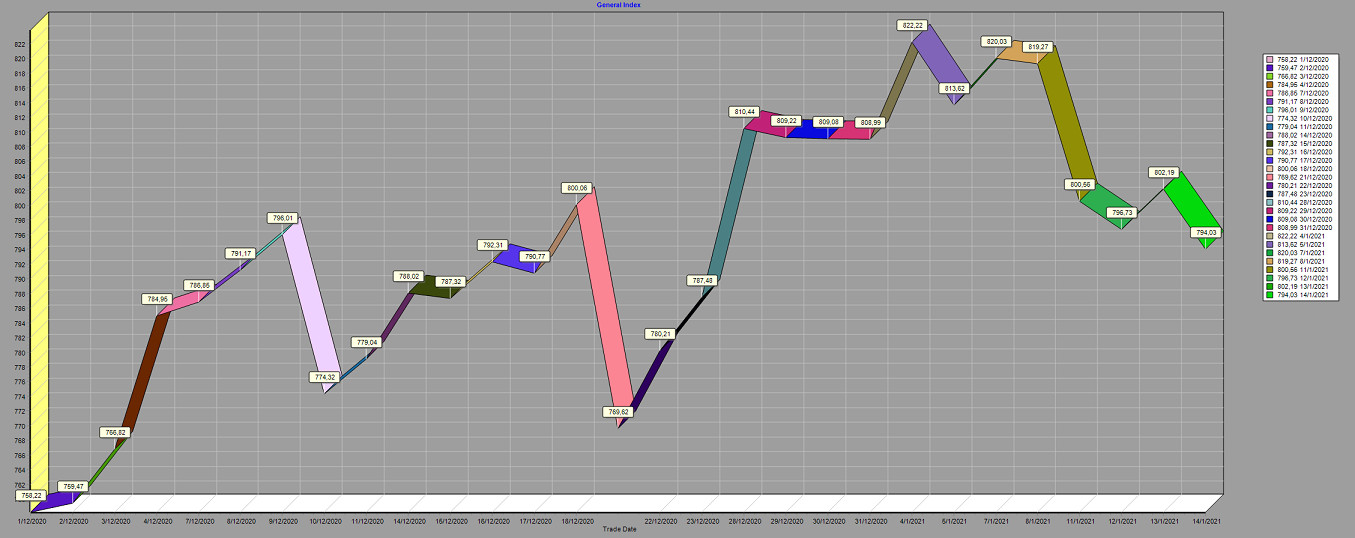

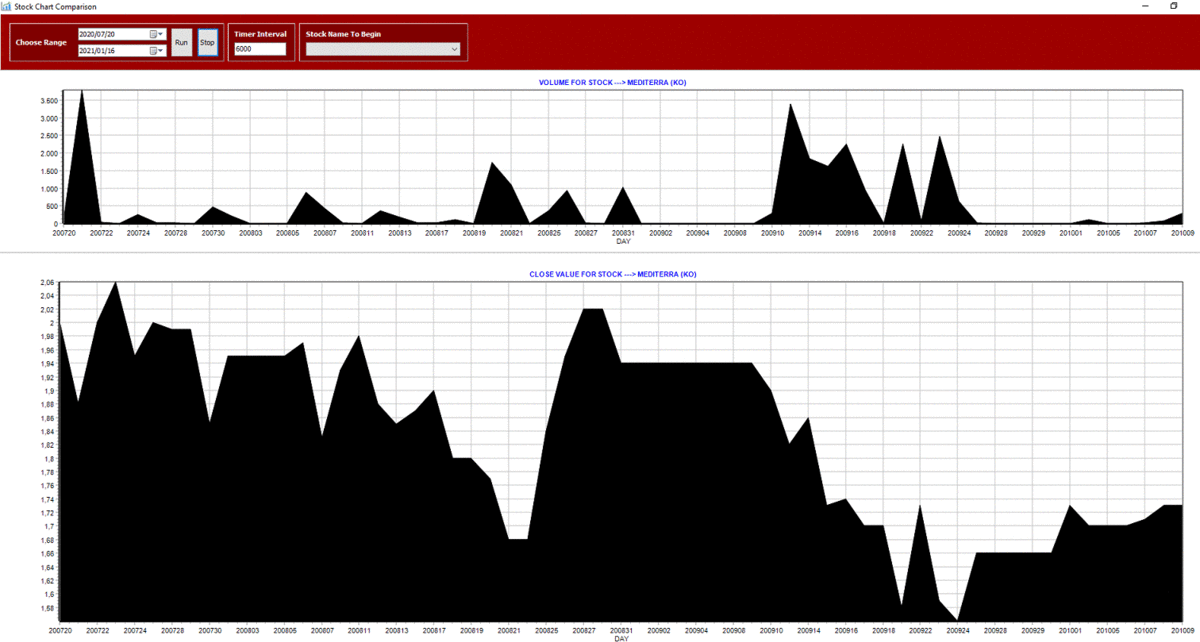

Innovative data visualisation tool for stocks comparison

Special visual effects have been implemented in order the investor to easily compare historical figures for all stocks at once. Charts with stock values are presented on the screen like a motion picture, letting the investor to configure time interval value between visual switchovers as well as other parameters. The graphs could have contained 10 years of stocks data but SMSI focuses on stock figures for the latest five years because the firm’s studies have shown that its future growth is more closely related to recent events than to the distant past.

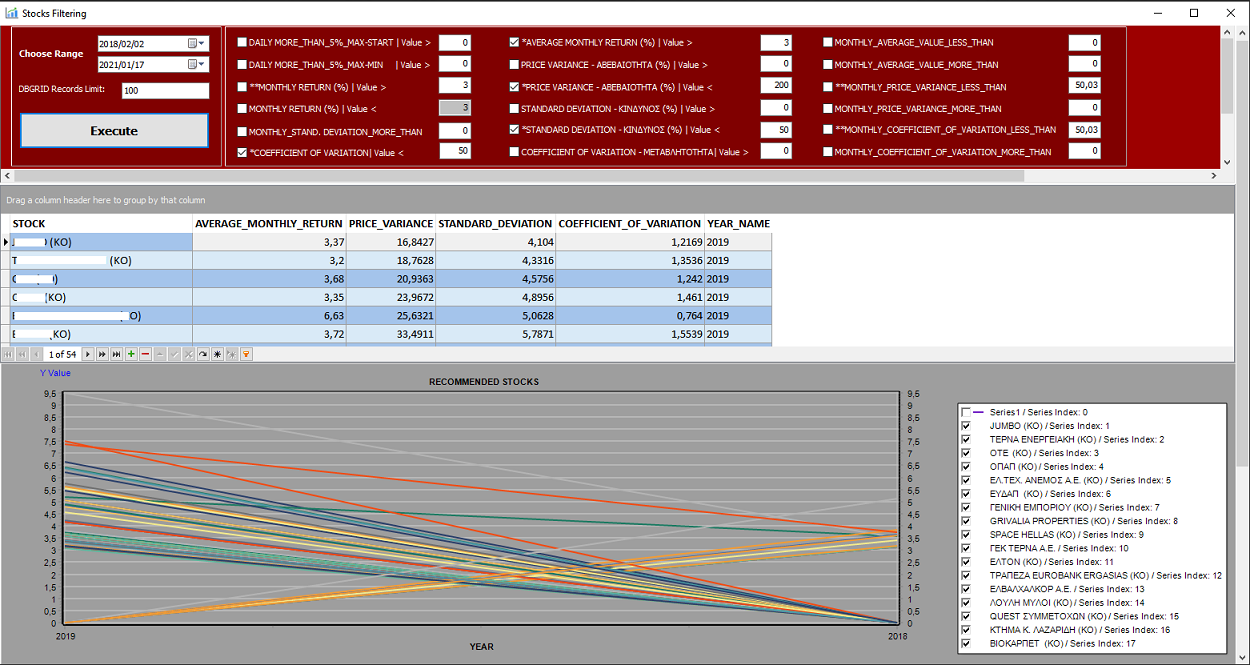

Advanced stock filtering techniques

S.M.S.I. enables the investor to retrieve the best stocks for his/her portfolio with almost no effort via the use of an advanced stock filtering engine.The investor can create his/her own custom filter according to his/her profile by choosing among a big set of stock related parameters that have been produced exclusively by the Math Engine of S.M.S.I. The process is simple since the investor only picks or even modifies the parameters and S.M.S.I. controls the whole computational complexity. S.M.S.I. in order to produce this palette of parameters runs calculations for every single stock for the last 20 years.

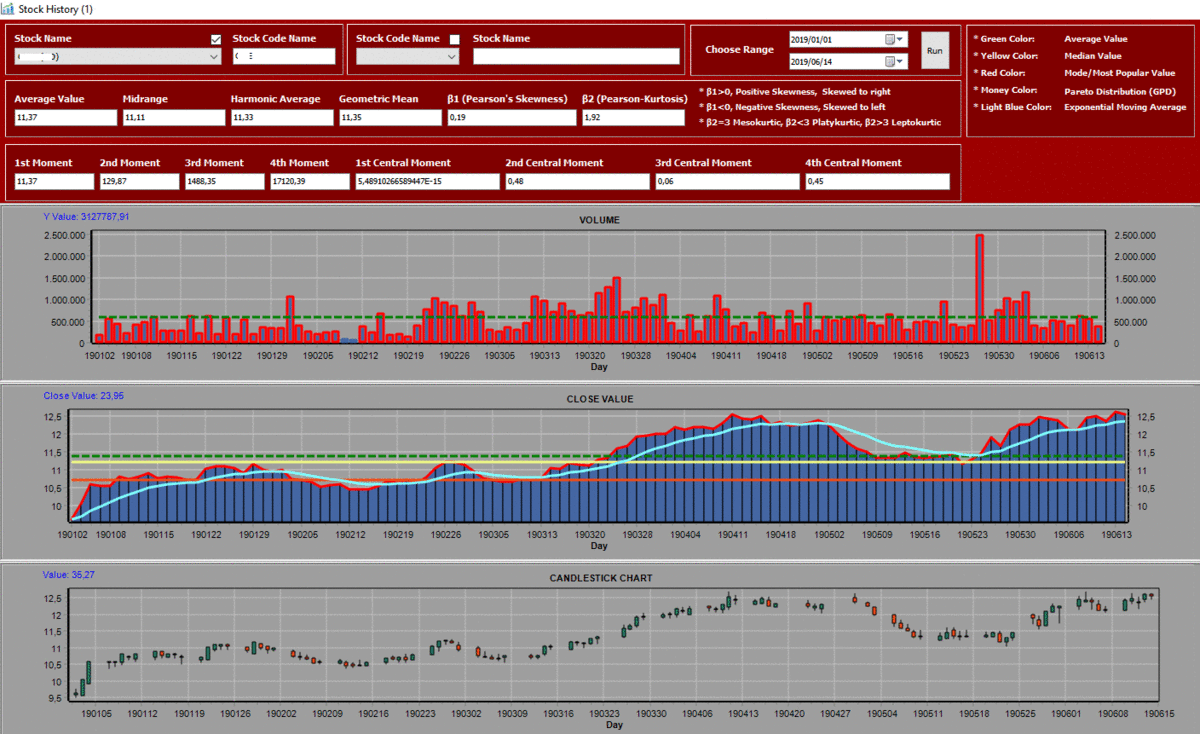

Superior technology for stocks analysis & forecast

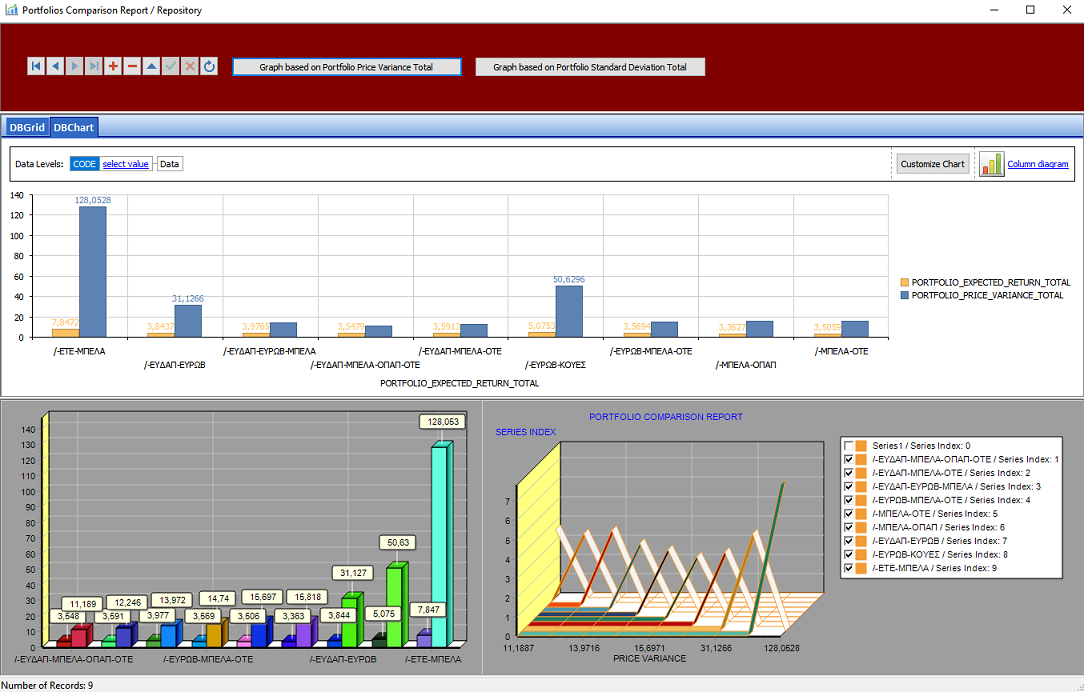

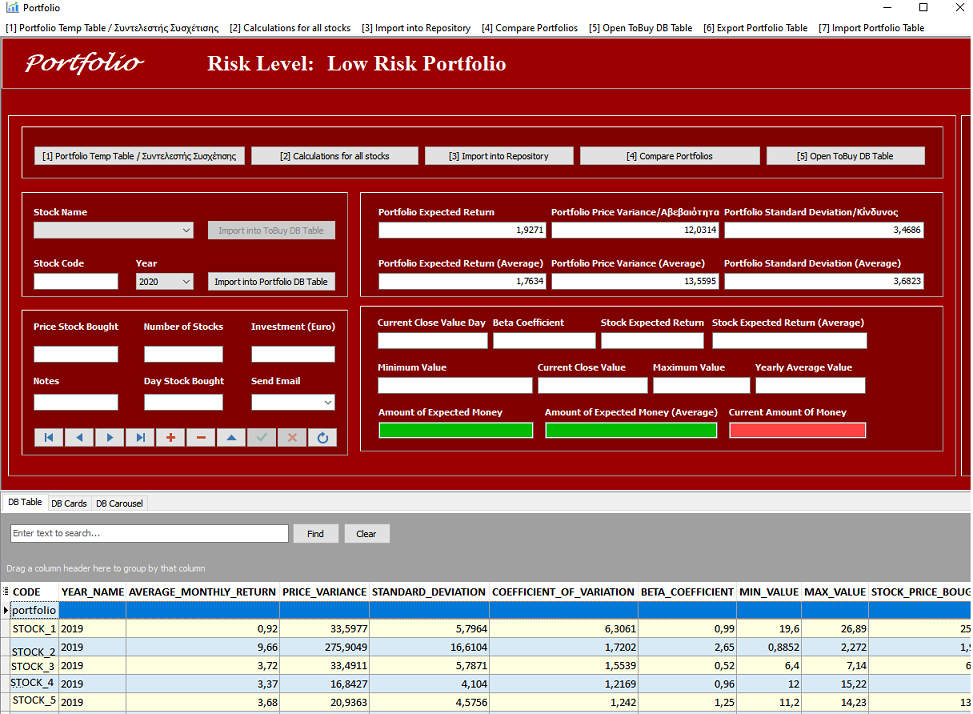

Create, analyse, compare virtual investment portfolios

Smart trading at the right time – When to sell & which stocks

Library essentials for beginner investor